Top 8 Budgeting Problems Companies Face in Fiscal Planning

Organizations around the world are working harder to than ever to deliver sustainable, profitable growth. Part of that growth strategy is achieved through fiscal planning, a process that involves compiling, monitoring, and updating a company’s revenue, spending, debt, and capital forecasts for the inclusion in the annual budget. It is a major operational task that comes once a year but tends to last for longer than expected.

If you ask any CFO of a large company, they have likely lost a few nights (or weeks) of sleep during this period of coordinating people, aligning numbers, and managing approvals. While there are many different contributors in the budgeting process, they are the ones who are ultimately responsible for defining goals, bench-marking business performance, making adjustments, and enforcing the budget company-wide. Needless to say, it can be a stressful time without the right systems and efficient processes in place.

Budgeting is essential to guide day-to-day revenue and expense decisions, allocate resources, and support financial goals in long-term fiscal planning. While it is designed to keep your company on track and pinpoint areas of improvement, the reality is, the budgeting process is not a straightforward task. Instead of profitability and productivity, the budgeting process is often time-consuming and highly labor intensive, with questionable value.

Embrace Continuous Planning To Adapt To Continuous Change

View Whitepaper NowTo get to the bottom of these issues, we did our research and identified the top eight budgeting problems most companies face in fiscal planning.

- Time

Multiple budget contributors working with multiplying versions of the same static spreadsheet take much time to coordinate, compile, and consolidate. From the time spent validating numbers to the lost hours spent tracking individual budget contributors down, many CFOs have reported spending upward of 250 hours of their time on the budgeting process alone. - Communication

There are a ton of moving parts within an entire company before, during, and after the budgeting process. Each stage requires input from budget creators, contributors, and approvers, but many companies don’t have a tool that helps them collaborate. They end up budgeting in silos, with no alignment with other departments or toward the end goal. - Complexity

Another problem that many budget owners face during the multi-layered budgeting process is dealing with deadlines and unpredicted changes. In what should be a simple fix, any modification or adjustment to a budget results in a complicated back and forth tango of redoing numbers, responding to questions, and re-sending spreadsheets. - Flexibility

When creating a budgeting document to be used by all managers in a company, it’s vital that the form or spreadsheet they are required to fill in be standardized and easy to understand. The trouble is, uncontrolled spreadsheets don’t allow for the structure and labeling you need for all your different budget contributors. As a result, many people get lost in the details and struggle with providing accurate responses. - Accuracy

When working with 30 to 100 Excel files (each with many versions), most companies end up relying on manual data entry and processes to piece it all together. With no easy way to drill down to the numbers, manual processes are infamous for resulting in human error, inconsistencies, and lack of control. - Optimization

Monitoring and adjusting your budget throughout the year is a highly efficient business practice that leads to higher returns and improved productivity. Unfortunately, it’s not used by many companies due to technology restrictions and the manual labor required to merge actuals and budgets. - Cost

Between all the time and resources that the six budgeting problems above consume, the total cost of many annual budgeting programs can add up. In addition to the labor costs of inefficient processes, many companies don’t experience the value that effective budgeting and fiscal planning should bring to the table. - Value

Perceived value is one of the biggest areas of concern in the budgeting process across the board. Is the money you’re spending on planning and budgeting actually worth it? Fiscal planning should help operating managers make informed decisions aligned with the company’s overall financial goals.

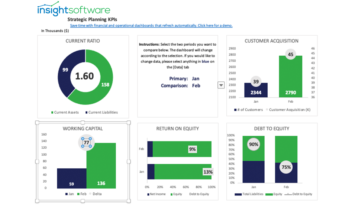

At insightsoftware, we have heard these budgeting problems from our reporting and analytics customers time and time again. In response, we want to change the way you budget with our new budgeting solutions.

Collaborative, Integrated, Finance-Owned Budgeting and Planning Applications

View Budgeting SolutionsOur budgeting software is a simple, adaptable, and an easy-to-use fiscal planning solution that controls and streamlines the budgeting process, connecting to over 140+ ERPs. With native Excel integration and an intuitive web portal, users can leverage their existing Excel skills and turn the budgeting process into an easily managed, systematic process that gets finished in half the time.

- Simplify the budgeting process to see results quicker – With an intuitive, spreadsheet-like interface, you can create any type of budget or forecasting planning form for a robust and cohesive planning process, without the need to work with multiple spreadsheets saved on individual PCs. Work with a single source of truth, and access up-to-date data at any time, and on any device. Create a repeatable, standard planning process, that automatically reflects changes in your ERP system. Use embedded analytics to monitor performance and detect trends, without relying on IT.

- Align your team and shorten budgeting cycles – save time by taking control of budget entry and approvals using powerful workflows and automated, coordinated email notifications to your team. Comment directly inside planning forms to streamline communication. Sophisticated data access rules and a full audit-trail of changes ensure adherence to governance and compliance needs. Export figures to Excel to work offline, and re-import with the click of a button.

- Continuously monitor and reforecast throughout the year – Adjust and adapt your plans and forecasts throughout the year. Research the best financial forecasting and corporate budgeting models available to find the one that better suit the company finance goals. Use rolling forecasts to drive agility and accuracy across the organization. Users login, enter their figures, and the system automatically updates forecast figures with a single click. Change existing models on the fly to adapt to evolving business needs. Keep track and compare your previous figures with built-in version control.

Get a Demo of our Budgeting Solutions

Affordable and flexible budgeting tool that works the way people expect a fiscal planning tool to work. Businesses can cut the time required for budget exercise in half, generate more accurate numbers, improve financial performance and productivity, and make faster decisions. If you are interested in getting control over your budgeting processes, click the link below to schedule a demo.